Ytd net pay calculator

For example if the pay period was 06062010 to 12012017 and the pay date was 15012017 you would enter 12012017 in the calculator. Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator.

Understanding Your Paycheck Credit Com

Earnings Statement Period Ending.

. Stub creator provides best calculator to calculate in hand salary for hourly and salaried employees on its free salary paycheck calculator tool. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator. The latest technology news and reviews covering computing home entertainment systems gadgets and more.

If you spend the entire 000 on expenditures that eventually become worthless you have limited your net pay for that one hour of work to just 000. Federal Filing Status of Federal. How often are you paid.

Unless you have post tax deductions from your pay then your net income is the same as the amount that you receive in your bank account. Switch to Illinois salary calculator. Which includes 9000 of superannuation then your salary package is worth 109000 your gross income is 100000 your tax withheld would be around 26000 and your net.

Pay Frequency Use 2020 W4. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. This paycheck stub is print-ready.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Switch to Florida hourly calculator. Prior YTD CP Enter either CP or HoursRate.

Use PaycheckCitys bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. Company Name Company Street Address 1 Company City NY 11106. Then calculate the YTD year to date for the duration of the time you were.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Switch to Indiana hourly calculator. Determine the annual tax T1 T2 based on the annual taxable income factor A with the non-periodic payment payable now.

An employee can use the calculator to compare net pay with different number of allowances marital status or income levels. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Our salary calculator has been updated with the latest tax. Your businesss total YTD in payroll is 65000. Use this federal gross pay calculator to gross up wages based on net pay.

We will then calculate the gross pay amount required to achieve your net paycheck. On the other hand if you invest 000 0 of one hours net pay for 0 years in an investment earning a 0 return you will have increased your net pay from that one hour of work from 000 to. Our free check stub maker with calculator will make an earnings statement with tax returns and figures out what you will owe each pay period to the state and local government.

The annual taxable income factor A is based on a yeartodate concept plus the estimated income for the rest of the pay periods in the year. YTD Net Pay 000. If you have only just started your job this financial year or dont want to work out your income from your group certificate then just enter 0 as the gross income shown on your.

Creating free paystub using Online Paystub Generator can be used as a paystub calculator and paycheck calculator. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Employees can calculate their net pay or take home pay by entering pay period YTD hourly and annual salary rate.

With Online Pay Stubs you can instantly Create pay stub for free within minutes. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. This number is the gross pay per pay period.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. YTD means yeartodate before this pay period.

Dish TV Consolidated June 2022 Net Sales at Rs 60863 crore down 1674 Y-o-Y Aug 10 2022 1008 AM Dish TV Standalone June 2022 Net Sales at Rs 31386 crore down 1359 Y-o-Y Aug 10 2022 0908 AM. Switch to North Carolina hourly calculator. It is simple flexible and easy to use and it is completely FREE.

Once you have calculated that add the two YTD amounts together. The year-to-date for Sage is 45500 and Sebastienne is 19500. Dont want to calculate this by hand.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Enter in previous YTD calculations. The PaycheckCity salary calculator will do the calculating for you.

Free pay stubs Calculator pdf file output and ready to print Easy paystub Paycheck Stubs check stub maker. Get 247 customer support help when you place a homework help service order with us. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Missouri hourly calculator.

These paycheck stubs can be used by employees as proof of their earnings employers can keep it for their records. Pay stub online really great tools 0123 456 70 90 Toggle navigation. Sage earned 3500 per pay period in gross wages and Sebastienne earned 1500 per pay period.

Take those numbers and multiply them by the number of pay periods. For example if you earn 109000 pa. Federal Filing Status of Federal Allowances.

It will take you from Gross Pay to Net pay and all in between calculations as well.

Gross Pay Vs Net Pay What S The Difference And How To Calculate Both Wrapbook

Net Pay Is Off By Cents

Pay Stub Maker Create A Paycheck Paycheck Stubs Stub Samples Words To Describe Year Of Dates Paycheck

Pin On Budget Templates

Year End Profit And Loss Statement Template Word Statement Template Income Statement Profit And Loss Statement

Sales Tracker Excel Template Sales Channels Performance Etsy Uk Sales Tracker Excel Templates Excel

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Free Excel Financial Forecast Model For Hospitals And Medical Institutes In 2022 Medical Business Financial Hospital

Paycheck Calculator Apo Bookkeeping

Paycheck Google Search Directions Check Mail Deposit

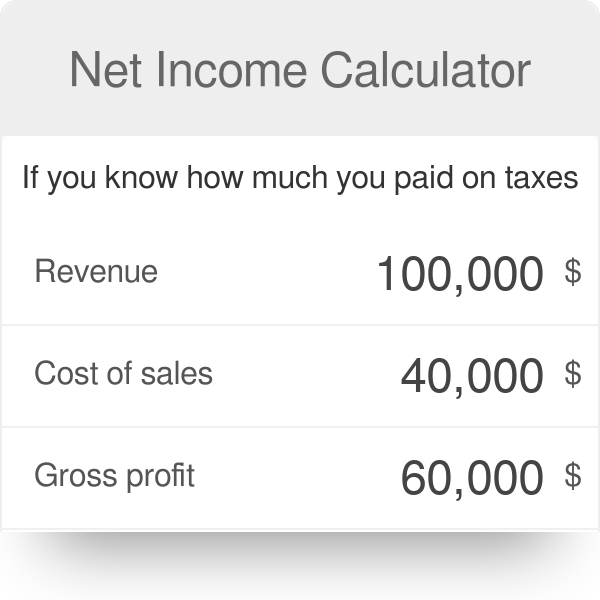

Net Income Calculator Find Out Your Company S Net Income

Tax Calculator For Weekly Pay Hot Sale 50 Off Www Ingeniovirtual Com

Syfpzufxyhj26m

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Online Paycheck Calculator Calculate Take Home Pay 2022